Just as medical expenses continue to rise, understanding how to navigate healthcare costs and save money on hospital bills is crucial for individuals and families. The financial burden of unexpected medical emergencies or planned procedures can be overwhelming, but there are 10 valuable strategies that can help individuals reduce their healthcare expenses.

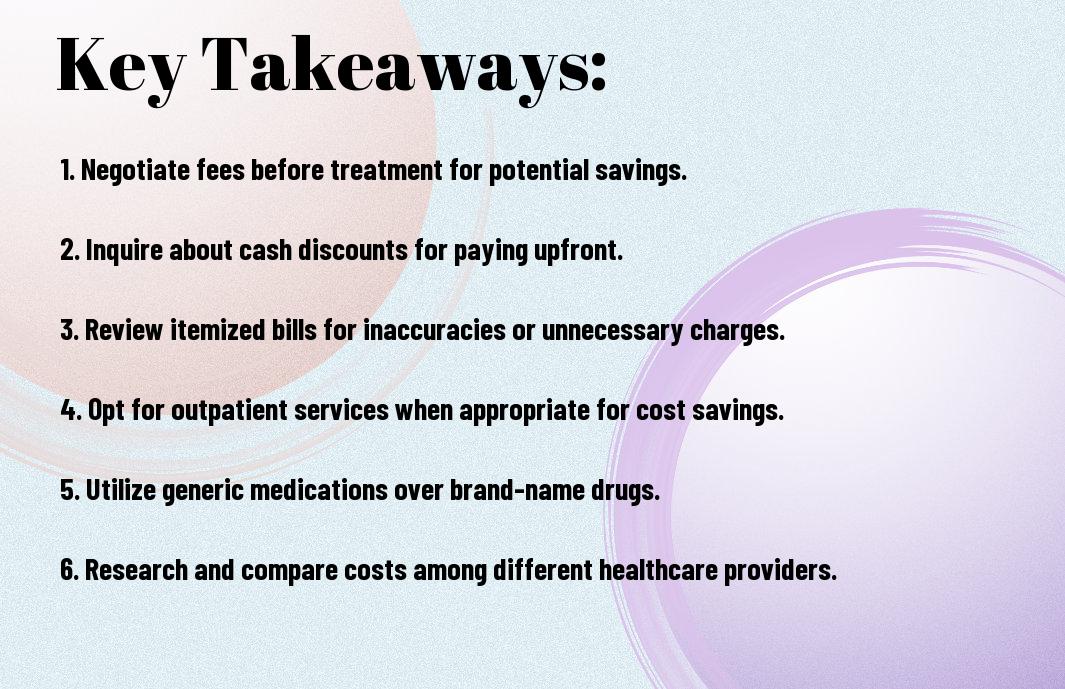

Key Takeaways:

- Negotiate your medical bills: Don’t hesitate to discuss payment plans, discounts, or assistance programs with the hospital billing department to reduce the financial burden.

- Stay in-network: Choosing healthcare providers, facilities, and services within your insurance network can significantly lower out-of-pocket costs.

- Review your hospital bill: Scrutinizing your hospital bill for errors or unnecessary charges can help you identify cost-saving opportunities and avoid overpaying for services.

Also Read : Why Trusting Your Instincts Can Be Crucial In Choosing The Right Hospital

Understanding Your Health Insurance Policy

You must understand your health insurance policy to effectively navigate healthcare costs. Without a clear understanding of your coverage, you may end up facing unexpected bills and financial strain. By educating yourself on your policy, you can make informed decisions regarding your healthcare and potentially save money in the long run.

Deciphering Coverage Limits and Deductibles

Health insurance policies often come with coverage limits and deductibles that can impact your out-of-pocket expenses. Coverage limits refer to the maximum amount your insurance will pay for covered services, while deductibles are the amount you must pay before your insurance kicks in. It is crucial to know these numbers to avoid financial surprises when receiving medical care.

Health insurance policies vary in terms of coverage limits and deductibles, so it is crucial to review your policy documents or contact your insurance provider for clarification. Understanding these details can help you plan and budget for healthcare expenses, ensuring you are prepared for any medical needs that may arise.

Also Read : The Role Of Hospitals In Mental Health – Promoting Wellness And Recovery

Importance of In-Network Providers and Facilities

Health insurance policies often have networks of preferred providers and facilities that offer services at discounted rates. Visiting in-network providers can lead to significant cost savings compared to out-of-network providers, who may charge higher fees that are not fully covered by your insurance.

Any discrepancies between in-network and out-of-network costs can result in substantial out-of-pocket expenses for you. By choosing in-network providers and facilities, you can save money and avoid unexpected bills, ultimately maximizing the benefits of your health insurance policy.

Preparing for Hospital Visits

To How to Save Money on Medical Bills, it is vital to be proactive and well-prepared before any hospital visit. By taking a few key steps in advance, you can potentially save yourself from unexpected financial burdens.

Pre-Admission Procedures and Financial Clearance

PreAdmission procedures involve gathering vital information from your healthcare provider, such as verifying your insurance coverage, determining any out-of-pocket costs, and understanding the billing process. Financial clearance ensures that your insurance information is up-to-date and accurate, reducing the risk of billing errors or surprises after your hospital stay.

Also Read : How Hospitals Are Adapting To Changing Healthcare Technologies

Asking the Right Questions Before Hospitalization

Asking key questions before hospitalization can help you better understand the financial aspect of your care. Inquire about your insurance coverage, any potential co-pays, deductibles, or coinsurance amounts. Additionally, ask for an estimate of the total cost of your treatment, including any additional fees or services that may be involved.

Hospital staff are there to assist you, so don’t hesitate to advocate for yourself by asking for clarification on any billing information that may seem unclear. Being proactive in understanding the financial aspects of your hospital visit can empower you to make informed decisions about your healthcare expenses.

Navigating In-Hospital Costs

For individuals facing a hospital stay, understanding and managing in-hospital costs is crucial in order to avoid exorbitant medical bills. In-hospital expenses can quickly add up, but with careful planning and knowledge, patients can take steps to minimize these costs and alleviate financial burdens.

Daily Hospital Costs and How They Accumulate

Costs associated with a hospital stay can accumulate rapidly on a daily basis. These expenses may include room charges, medication costs, diagnostic tests, doctor consultations, and various additional services. It is necessary for patients to be aware of these charges and how they contribute to the overall hospital bill to better navigate and plan for potential financial obligations.

Also Read : Healthy Habits For Hospital Staff – Self-Care Tips For Healthcare Professionals

Costs can escalate further if unexpected complications arise during the hospitalization, leading to additional treatments or procedures. Understanding the breakdown of daily expenses and staying informed about the services being provided can empower patients to make informed decisions about their care while being mindful of the associated costs.

Ways to Minimize Inpatient Expenses

Costs associated with inpatient care can be daunting, but there are strategies to help minimize these expenses. One effective way is to review and understand your health insurance coverage to determine what is included and what may be subject to out-of-pocket costs. Additionally, communicating openly with the healthcare team about cost concerns can often lead to more cost-effective treatment options.

Costs can also be reduced by actively participating in discharge planning to ensure a smooth transition from the hospital to home or a lower level of care. This proactive approach can help prevent unnecessary extended stays, which can significantly impact the final hospital bill.

Any patient facing inpatient care should take proactive steps to minimize expenses by understanding the breakdown of daily costs, communicating openly about financial concerns, and actively participating in discharge planning. By being proactive and informed, patients can navigate in-hospital costs more effectively and alleviate the financial burden associated with a hospital stay.

Also Read : 10 Essential Tips For A Smooth Hospital Visit

Medication and Treatment Alternatives

Once again, when it comes to managing healthcare costs, exploring medication and treatment alternatives can be a game-changer. By being informed about generic vs. brand-name drugs and exploring different treatment options, you can potentially save a significant amount of money on your hospital bills.

Generic Vs. Brand-Name Drugs: Cost Comparison

Cost is often a major factor when it comes to choosing between generic and brand-name drugs. Here is a comparison between generic and brand-name drugs:

| Generic Drugs | Brand-Name Drugs |

| Cost-effective | Expensive |

| Contain the same active ingredients | Heavily marketed |

| Strictly regulated by the FDA | May have minor variations in inactive ingredients |

Exploring Different Treatment Options and Their Costs

Options for treatment can vary widely in cost, and it’s vital to explore different alternatives to find the most cost-effective solution for your healthcare needs. Some options to consider include:

Drugs that have been on the market for a long time and have generic versions available are usually much more affordable than newer brand-name drugs. It’s important to discuss with your healthcare provider the possibility of switching to a generic equivalent to save on costs without compromising on quality.

Aftercare and Post-Hospitalization Expenses

Unlike the flat fee of a hospital stay, post-hospitalization expenses can be more variable and unpredictable. It is crucial to plan and budget for aftercare and post-hospital care early to avoid financial strain. These costs can include follow-up visits with healthcare providers, rehabilitation services, medication, medical equipment, and home care services.

Planning for Post-Hospital Care Early

Aftercare following a hospital discharge is a critical component of the recovery process, and it is important to plan for these expenses in advance. Start by discussing with the healthcare team to understand the recommended aftercare services and associated costs. Investigate options such as rehabilitation facilities, home healthcare providers, and medical equipment suppliers. By planning early, you can optimize your budget and explore cost-saving opportunities, such as insurance coverage and financial assistance programs.

Outpatient Services and Home Care Options to Reduce Costs

Care options such as outpatient services and home care can help reduce post-hospitalization expenses significantly. Outpatient services, such as physical therapy and follow-up appointments, are generally less costly than inpatient care. Home care options, including nursing care and assistance with daily activities, can also be more affordable than a prolonged hospital stay. Consider discussing these options with the healthcare team to determine the most suitable and cost-effective care plan for the patient’s recovery.

With the rise of telemedicine and virtual healthcare services, patients now have more convenient and cost-effective options for post-hospital care. These virtual services can provide medical consultations, monitoring, and support from the comfort of home, reducing the need for in-person appointments and associated costs. Consider exploring telemedicine options as a modern and efficient way to receive quality care while managing expenses.

Dealing with Hospital Billing Errors

Many individuals find themselves overwhelmed when faced with hospital bills that seem inaccurate or inflated. Dealing with hospital billing errors can be a frustrating and time-consuming process, but it’s crucial in order to avoid unnecessary financial strain. In this chapter, we will discuss how to identify common billing mistakes and the steps to dispute and correct these errors.

Identifying Common Billing Mistakes

Hospital billing errors can occur for a variety of reasons, including coding mistakes, incorrect insurance information, duplicate charges, or services that were not provided. It’s imperative to carefully review all charges on your hospital bill to ensure accuracy. Some common billing mistakes include being charged for medications or supplies you didn’t receive, being billed for the wrong level of care, or even incorrect patient information. These errors can lead to significant financial implications if not addressed promptly.

Identifying these common billing mistakes requires a keen eye for detail and an understanding of medical billing procedures. Patients should compare their itemized bill to any documentation they have from their hospital stay to catch discrepancies. It’s also helpful to keep track of any communication with the billing department for future reference. If you notice any irregularities, it’s crucial to address them as soon as possible to avoid further complications.

Steps to Dispute and Correct Billing Errors

Billing errors are not uncommon in the healthcare industry, and it’s imperative to know how to dispute and correct them effectively. The first step is to contact the hospital’s billing department and request an itemized statement of your charges. Review this statement carefully and highlight any discrepancies or questionable charges. Next, submit a formal dispute in writing, including supporting documentation such as medical records or receipts.

It’s important to follow up with the hospital’s billing department after submitting your dispute to ensure it is being processed. Be persistent in advocating for yourself and don’t hesitate to escalate the issue to a supervisor if necessary. By taking proactive steps to dispute and correct billing errors, you can potentially save yourself from paying unnecessary costs and protect your financial well-being.

Financial Assistance and Payment Plans

All individuals deserve access to quality healthcare, regardless of their financial situation. Navigating healthcare costs can be overwhelming, but there are various options available to help manage and reduce hospital bills. Financial assistance programs and payment plans are valuable resources that can lighten the financial burden of medical expenses.

Applying for Hospital Financial Aid Programs

To alleviate the financial strain of hospital bills, individuals should explore financial aid programs offered by hospitals. These programs are designed to assist patients who are unable to afford their medical bills. Eligibility criteria vary among hospitals, but they typically consider factors such as income level, family size, and medical expenses. It is crucial to reach out to the hospital’s billing department to inquire about available financial aid options and submit the necessary documentation to support your application.

Negotiating Payment Plans and Discounts with the Hospital

Any individual facing challenges in paying their hospital bills should consider negotiating payment plans and requesting discounts directly from the hospital. Hospitals understand the financial strain that medical bills can impose on patients and are often willing to work with individuals to create manageable payment arrangements. Discussing your financial situation with the hospital’s billing department can lead to the establishment of a payment plan that suits your budget. Moreover, some hospitals may offer discounts for individuals who are able to pay their bills in a lump sum or within a shorter timeframe.

Plans for negotiating payment plans and discounts with the hospital can significantly reduce the financial burden of medical bills. By advocating for yourself and exploring available options, you can work towards a more feasible solution for managing healthcare costs. Be mindful of, hospitals are invested in the well-being of their patients and are often willing to collaborate to find a mutually beneficial resolution.

Final Words

Following this comprehensive guide on how to save money on hospital bills is vital for anyone looking to navigate healthcare costs effectively. By being proactive, negotiating costs, and exploring alternative options, you can significantly reduce your medical expenses and alleviate financial stress. Remember that being informed and assertive in your approach can make a substantial difference in how much you end up paying for healthcare services.

Always remember that healthcare costs can be overwhelming, but with the right strategies and resources, you can effectively manage and minimize them. By implementing the tips provided in this article, you can take control of your healthcare expenses and pave the way for a more financially secure future.

Also Refer : The Future Of Hospitals – How Technology Is Transforming Healthcare

FAQs

Q: Why are healthcare costs so high?

A: Healthcare costs are influenced by a variety of factors, including the price of medical services, administrative costs, and the prevalence of chronic conditions. Additionally, the complexity of the healthcare system can lead to confusion and inefficiencies, driving up costs.

Q: How can I save money on hospital bills?

A: There are several ways to save money on hospital bills, including negotiating with the hospital for lower prices, verifying the accuracy of your bill, exploring financial assistance programs, and opting for outpatient services when possible.

Q: What should I do if I receive a high hospital bill?

A: If you receive a high hospital bill, it’s important to review the bill carefully and request an itemized statement to ensure accuracy. You can also reach out to the hospital’s billing department to discuss payment options or negotiate a lower price.

Q: Are there government programs that can help me with healthcare costs?

A: Yes, there are government programs such as Medicaid and Medicare that provide financial assistance for eligible individuals. These programs can help cover healthcare costs, including hospital bills, for those who qualify based on income and other criteria.

Q: How can I better understand my health insurance coverage?

A: To better understand your health insurance coverage, review your policy documents carefully to learn about your benefits, deductibles, copayments, and out-of-pocket maximums. You can also contact your insurance provider for assistance in understanding your coverage and explaining any costs associated with hospital visits.